WAGI Aims to Transform Lives with Free and User-Friendly Financial Learning Tools

In a landmark event on July 31, 2024, FedCenter showcased its groundbreaking initiative aimed at enhancing financial literacy among Filipinos with the introduction of WAGI (Wealth Advice for Growth and Inclusion). As the first-ever app-based platform dedicated to financial education in the country, WAGI promises to make learning about personal finance both accessible and enjoyable.

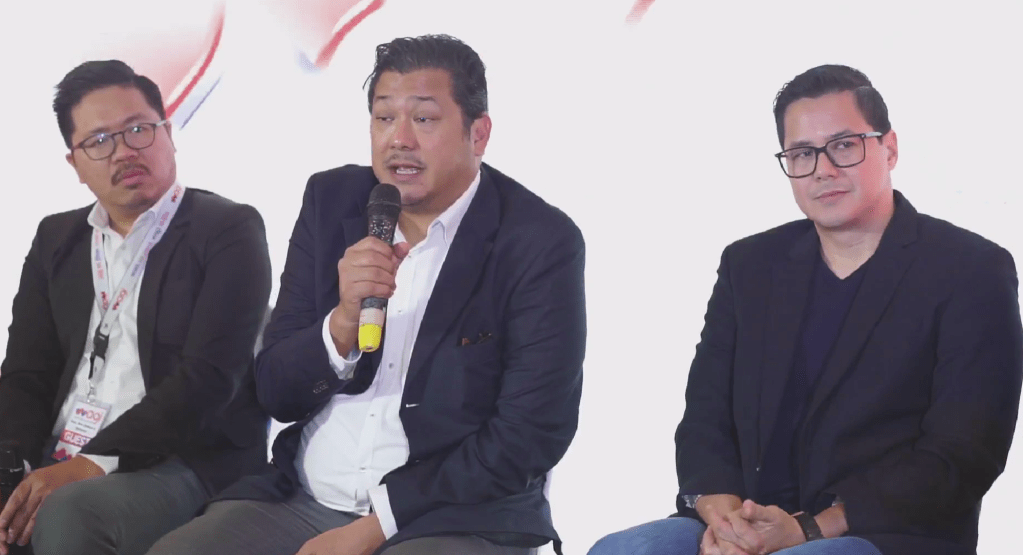

Marc Christian Gulle, President of FedCenter, enthusiastically declared, “FedCenter is very proud to launch WAGI. This app will democratize financial literacy and can significantly uplift the financial well-being of all Pinoys.” His statement underscores the overarching goal of this initiative: to empower individuals through improved financial skills that can lead to better life choices.

Although the WAGI app is yet to be available for download on Google Playstore and iOS App Store, its design focuses on user-friendliness and accessibility. The tagline, “Wais sa pera, wagi sa life!” translates to “Wise in money, winner in life,” encapsulating the essence of what WAGI aims to represent for its users.

The platform offers a wide range of practical content that addresses various aspects of personal finance. From basic budgeting techniques to more complex topics like stock investing, WAGI provides engaging and easily digestible modules tailored specifically for the daily lives of Filipinos. Furthermore, users can look forward to quick finance tips from successful personalities and celebrities, making the learning experience relatable and motivating.

As mobile technology continues to evolve, FedCenter’s WAGI stands out as a transformative step towards achieving financial inclusion across the Philippines. By harnessing the power of technology and delivering relevant educational content, this innovative platform is set to reach a broad audience—ultimately fostering a more financially literate society.

The event was graced by influential speakers from various government agencies including the Securities and Exchange Commission (SEC), Credit Information Corporation (CIC), National Privacy Commission (NPC), and the National Development Company (NDC). Their contributions underscored the urgent need for improved financial understanding in the nation.

Francisco Coco Mauricio, President and CEO of WeFund, hailed WAGI as a pivotal initiative for promoting financial empowerment. “We are honored to be a major sponsor of WAGI,” he stated. “JuanHand, as the leading fintech cash lender in the Philippines, strongly advocates for financial inclusion. Financial literacy is essential for inclusion, ultimately leading to financial empowerment—a cornerstone of national development.” Mauricio called on other organizations to join forces in supporting this venture to ensure its sustainability and success.

What sets WAGI apart is its unique engagement strategy. After each educational module, users can take tests that transform their scores into reward points. These points are redeemable at various partner establishments, including popular fast-food chains, thereby encouraging active participation in learning about personal finance.

Adding a touch of celebrity appeal to the launch were Kyosu Guinto and Jaja Disuangco, known collectively as the #KyoJa love team. Their presence not only attracted media attention but also aligned with the initiative’s goal of making financial literacy relatable and engaging to younger audiences.